Performance Calculator

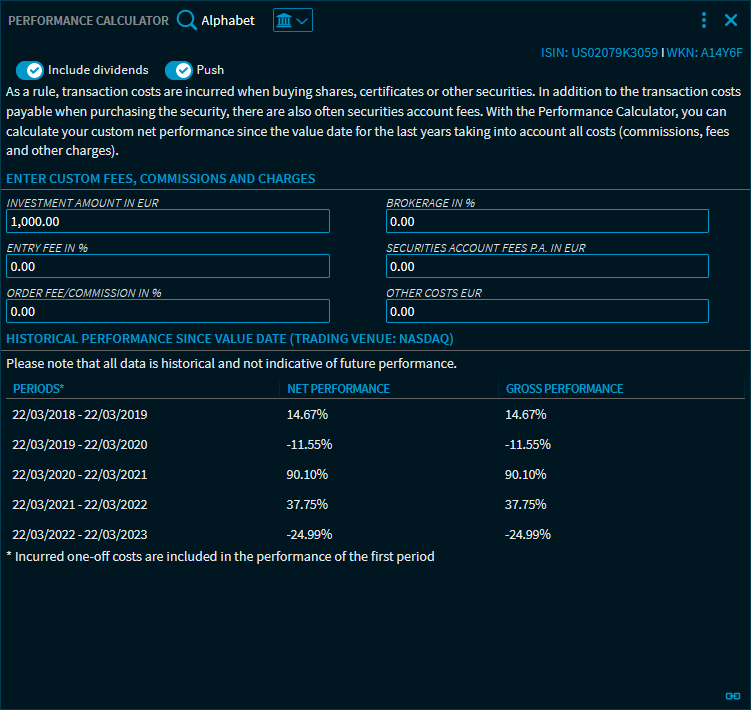

As a rule, transaction costs are incurred when buying securities. In addition to the transaction payable when buying securities, there are also often securities account fees. With the Performance Calculator, you can determine your individually adjusted performance (taking into account all costs such as commissions, fees and other charges) since the value date.

In the Performance Calculator, you first select a security and then enter an investment amount as well as the fees, commissions and other charges. The calculated net performance is compared to the gross performance (without these costs).

In addition to the standard elements of the widget, you find the following elements in the "Performance Calculator" widget:

Field | Description |

|---|---|

Select security | Use the quick search at the top of the widget to select the relevant security. After selection, the name of the security currently displayed in the widget is shown. |

Basic security information | At the top right of the widget, you will see the ISIN and WKN after selecting a security. |

Include dividends | Drag this switch, which is enabled by default, to the left if the dividends are not to be taken into account in the calculations. |

Push | If you do not want to push data supply, pull this switch to the left (activated by default). |

Investment amount in EUR | Enter the investment sum for the analysis. |

Brokerage in % | Enter the brokerage incurred in percent. The brokerage for security purchases is a one-off cost and is therefore considered in the net performance of the first period. |

Initial charge in % | Enter the initial charge (for funds) in percent. Front-end loads are one-off cost items and are therefore considered in the net performance of the first period. |

Order fee/commission in % | Enter the incurred order fee or commission in percent. Commissions and order fees are one-off costs and are therefore considered in the net performance of the first period. |

Other costs in EUR | Enter the amount of the other incurred one-off costs of the investment. "Other costs" are one-off costs and are therefore considered in the net performance of the first period. |

Securities account fees p.a. in EUR | Enter the annual securities account fees for the instrument. The securities account fees are ongoing charges and are therefore considered in the net performance of all periods. |

Historical value development since the value date

In brackets, you see the stock exchange for the calculation. This can be changed by using the trading venue drop-down list at the top of the widget.

Column | Description |

|---|---|

Period | For example, the last 5 years (counted from the current date) are shown as analysis periods. The upper row corresponds to the period directly following a "virtual" purchase (that is, the value date). |

Net performance | For each period, you see the percentage net performance of the security. Unlike the gross performance, the net performance takes into account the entered costs. The entry costs, that is, the fees incurred when buying the security, are taken into account in the first period, the ongoing charges are taken into account also in all following years. |

Gross performance | For each period, you see the percentage gross performance of the security. Unlike the net performance, the gross performance does not consider the entered costs. |

Note that the figures refer to the past and that past performance is not a reliable indicator of future results.

In the Widget Gallery, you find the "Performance Calculator" widget in the "Calculator" section of all security types.