Select values for the simulation

In the "Simulation" column, specify the scenario for the warrant that you want to compare to the current values. Enter the values that you expect or use the slider to set them. You can select the following values for the simulation:

Field | Description |

|---|---|

Last price (warrant) | The current and simulated price of the warrant. |

Price of underlying | The current and simulated price of the warrant. |

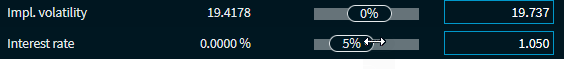

Impl. Volatility | The current and simulated implied volatility. |

Interest | The current and simulated risk-free market interest rate. To change the interest rate by using the slider, you first need to enter an initial value in the input field to the right.

|

Dividend yield | Current and simulated dividend yield of the underlying. The dividend yield results from the estimated dividends per share (usually, two business years in the future), divided by the current price multiplied by 100. To change the dividend yield by using the slider, you first need to enter an initial value in the input field to the right.

|

Calculation date | Use the integrated calendar to select the date for the simulation. The current date is set by default. |

Exchange rate | The current and simulated price exchange rate. |

| Click this icon in the "Simulation" column header to reset the value entered. |

The result of the simulation is shown directly on the right side of the widget - in the chart as well as the calculated figures.