Triple Exponential Moving Average

Type

Other indicator

Short introduction

The TEMA, like DEMA and DEMA2, was presented by Patrick G. Mulloy as a further modification of the exponential moving average. The DEMA, TEMA and DEMA2 variants differ in the trend model used. While DEMA is based on a linear regression model (that is, trend lines), TEMA is based on a quadratic regression model, so the trend term can still contain curved parts that depend quadratically on time.

Statement

TEMA and DEMA are linear combinations of single, double and triple exponential averages. The double and triple averages are used to estimate the trend-related correction.

Formula/calculation

EMA1 = EMAn(S)

EMA2 = EMAn(EMAn(S))

EMA3 = EMAn(EMAn(EMAn(S)))

DEMA = EMA1 + (EMA1 - EMA2)

= 2 × EMA1 - EMA2

TEMA = EMA1 + DEMA(S - EMA1)

= 3 × EMA1 - 3 × EMA2 + EMA3

where:

S = Time series to be smoothed

n = Period number for DEMA and TEMA

Interpretation

A basic "MACD-TEMA" trading system can apply the principle of linear combination of its exponential averages from TEMA to the MACD in its default setting (12/26/9). This basic trading system generates buy signals when the indicator breaches its trigger from button to top, and sell signals when it breaches its trigger from top to bottom.

Default setting

- Depending on trend periods, for example 9 periods

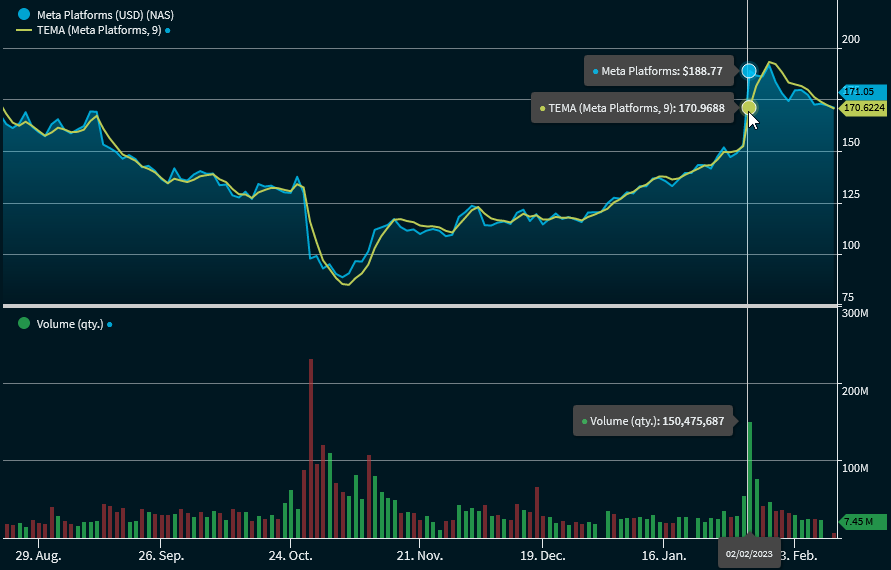

Example: TEMA