Covariance

Type

Comparison indicator

Description

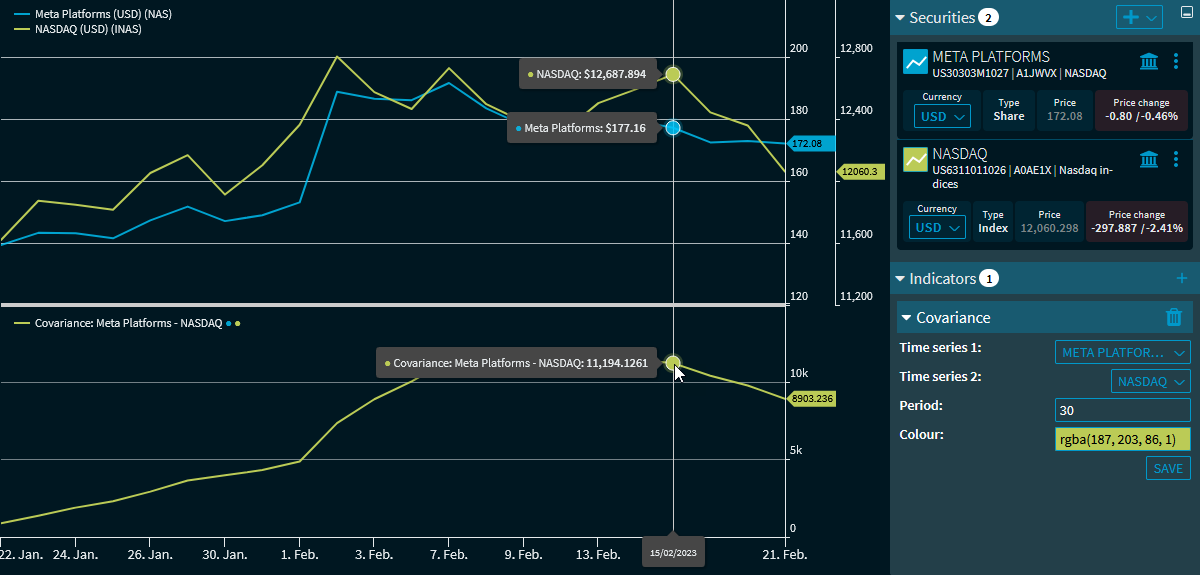

The "Covariance" indicator calculates the covariance between two securities. This means that at least two securities (or at least two time series) must be displayed in the "Chart analysis" widget. In the indicator settings, select the corresponding time series or securities.

The covariance shows the relation of two values. A positive covariance means a positive dependence, a negative covariance means an inverse relationship of the two values.

Formula/calculation

Cov(x,y) = Σ [(xi - xm) * (yi - ym)] / (n - 1)

where:

xi = one data point (expression)

xm = The average of the x data points

yi = a data point corresponding to data point xi

ym = The average of the y data points

n = number of data points

Parameter

- Time series 1

- Time series 2

- Period: The default setting is 30 periods

Example: Covariance