Beta

Type

Comparison indicator

Description

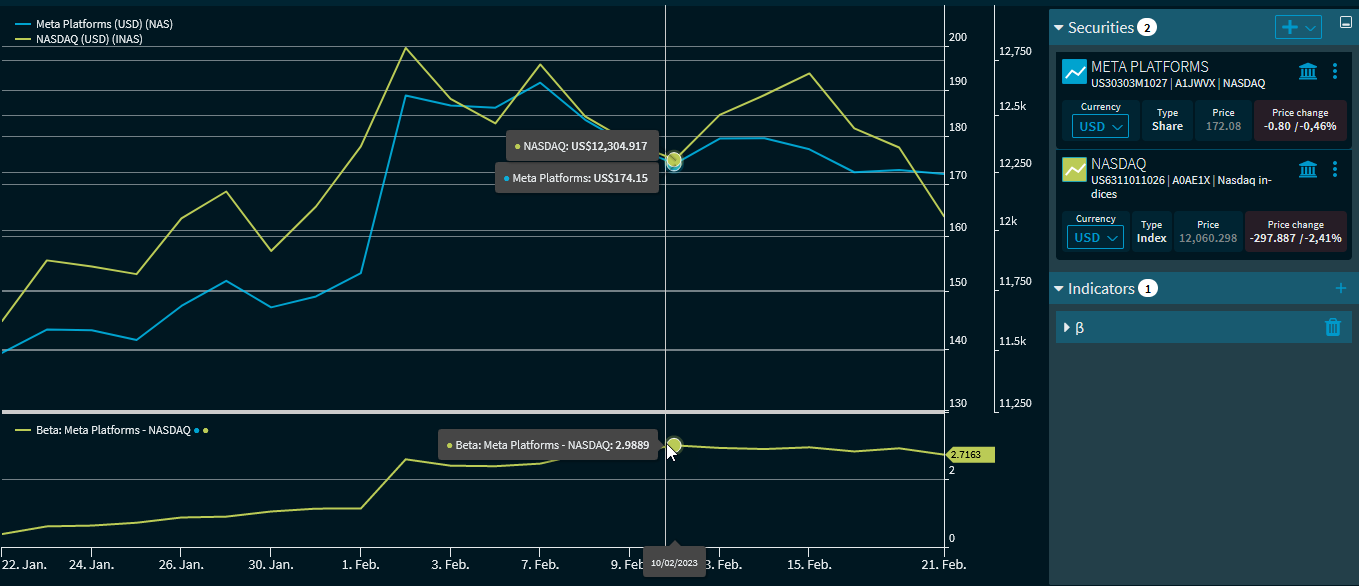

The "Beta" indicator calculates the beta between two securities or between security and benchmark/index. This means that at least two securities (or at least two time series) must be displayed in the "Chart analysis" widget. In the indicator settings, select the corresponding time series or securities.

The beta thus indicates, for example, how strongly a share fluctuates compared to the market. With a value of +1, the share fluctuates as much as the average. If the value is below +1, this indicates a lower fluctuation. With a value above +1, the share fluctuates more than the average. A negative beta means that the return of the share moves in the opposite direction to the benchmark.

Formula/calculation

Beta = Covariance(security yield,benchmark yield)/Variance(benchmark yield)

Parameter

- Time series 1

- Time series 2

- Period: The default setting is 14 periods

Example: Beta