Benchmark Bond Spread Calculator

The Benchmark Bond Spread Calculator allows you to compare the spreads between various countries. You can use the start time and time to maturity to show the data for the spreads.

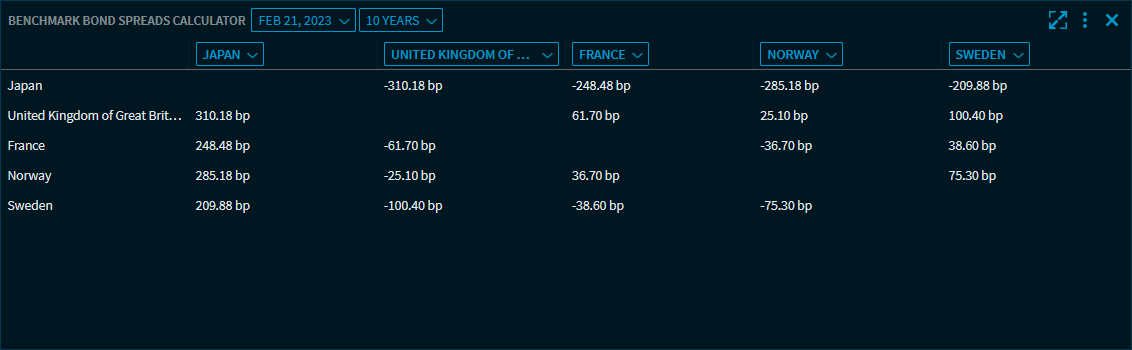

With the two drop-down lists at the top, you select the start date (the current date is set by default) and the time to maturity. For the time to maturity, you can select from various durations up to 30 years.

The 5 drop-down lists allow you to select up to 5 different countries.

The calculated spreads in basis points are shown in the matrix of the calculator. For example, the figure shows that the yield on 10-year government bonds is higher in all selected countries than in Germany, and so on.

Select a value from the matrix to plot the development of the selected spread over time.

In the Widget Gallery, you find the "Benchmark Bond Spreads Calculator widget in the "Defaults" section of the widgets for bonds.

See also: