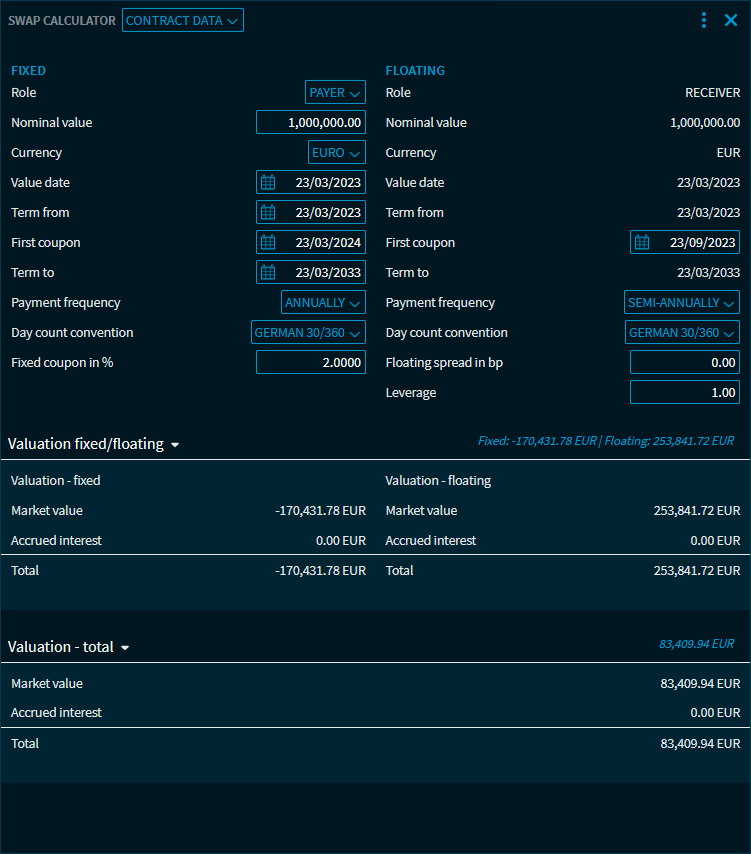

"Contract data" view in the Swap Calculator

The "Contract data" view is the default view of the "Swap Calculator" widget.

Enter the data for the valuation of a swap. The results of the valuation are shown in the lower part of the Swap Calculator. You see the market value without accrued interest, the accrued interest and the market value with accrued interest. In addition, you see the total valuation.

You find the following elements in the "Contract data" view:

"Fixed" area

| Element | Description |

|---|---|

| Role | Select the role of the "Fixed" party. "Payer" (default) or "Receiver". This setting changes the sign of the cash flow. |

| Nominal amount | Enter the (fixed) nominal amount of the swap transaction. The nominal amount for "Fixed" and "Floating" remains unchanged. |

| Currency | Select the (fixed) currency of the swap transaction. The currency for "Fixed" and "Floating" remains unchanged. |

| Value date | Use the integrated calendar to specify the valuation date of the swap transaction. The value date cannot be before the start date of the swap transaction that you enter in the "Term from" field. |

| Term from | Use the integrated calendar to specify the start date of the swap transaction. |

| First coupon | Use the integrated calendar to specify the date of the first fixed interest payment of the swap transaction. |

| Term to | Use the integrated calendar to specify the end date of the swap transaction. |

| Payment frequency | Select the payment frequency for the fixed interest payment. The following periods are available:

|

| Day count convention | Select the day count convention for the fixed interest payment. The following periods are available for the day count convention:

|

| Fixed coupon in % | The fixed interest payment in percent of the swap transaction. You can enter up to 4 decimal places here. |

"Floating" area

| Element | Description |

|---|---|

| Role | The role of the "receiver". The role is the one you selected in the "Fixed" area. |

| Nominal amount | The (floating) notional amount of the swap transaction. |

| Currency | The currency of the swap transaction. The currency for "Fixed" and "Floating" remains unchanged. |

| Value date | The value date selected in the "Fixed" area. |

| Term from | The start date selected in the "Fixed" area of the swap transaction. |

| First coupon | Use the integrated calendar to specify the date of the first floating interest payment of the swap transaction. |

| Term to | The end date date selected in the "Fixed" area of the swap transaction. |

| Payment frequency | Select the payment frequency for the floating interest payment. The following periods are available:

|

| Day count convention | Select the day count convention for the floating interest payment. The following periods are available for the day count convention:

|

| Floating spread in % | The floating margin of the swap transaction in basis points added to the interest rate. |

| Leverage | Enter the leverage. |

"Valuation" area

| Element | Description |

|---|---|

Market value "Fixed" valuation | The sum of the fixed cash flow. |

Market value "Floating" valuation | The sum of the floating cash flow. |

Accrued interest "Fixed" valuation | The sum of the fixed accrued interest. |

Accrued interest "Floating" valuation | The sum of the floating accrued interest. |

Market value "Total" valuation | The sum of entire cash flow. |

| Accrued interest "Total" valuation | The sum of the accrued interest rate (of the fixed and floating side). Here, the accrued interest is calculated (provided the start date is before the value date) based on the set day count convention, floating reference interest rate and days between start and value date. |