Fair Value Calculator (Share)

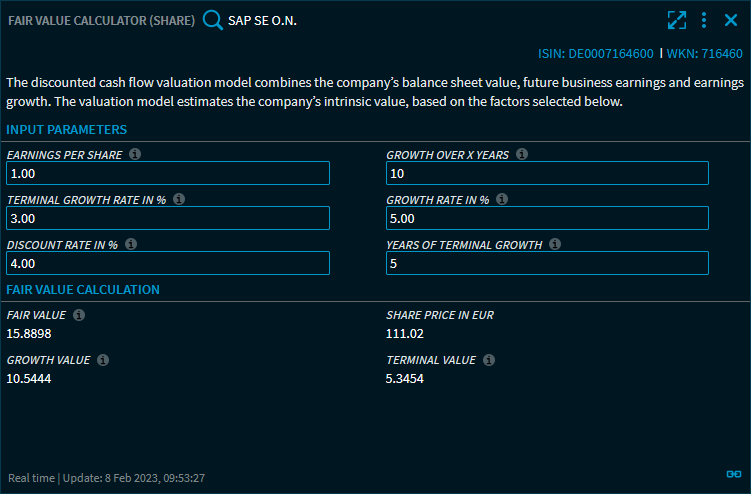

With the "Fair Value Calculator (Share)" widget, you estimate the value of shares according to the "discounted cash flow" valuation model ("DCF method"). The valuation model uses the company's balance sheet value to take into account future income and earnings growth. The model estimates the company’s intrinsic value, based on the parameters selected below.

First select the share to be valued viaby using the instrument search in the top left of the widget. In the "Input parameters" area, enter your values to see the results in the "Fair Value Calculation" area.

The individual fields mean:

Field | Description |

|---|---|

Earnings per share | Enter the earnings per share in this input field. Default value for earnings per share (without non-recurring items) is the trailing 12 months GAAP earning. |

Growth over x years | Enter the number of years you expect during the growth stage. The default is 10 years. |

Terminal growth rate in % | Enter the terminal growth rate in percent in this input field. After the growth stage, it is reasonable to set the terminal growth rate at the inflation rate. The terminal growth rate must be smaller than the discount rate to make the calculation converge. |

Growth rate in % | Enter the average annual growth rate in percent. The default value for the growth rate is the average earnings per share (EPS) without non-recurring items (NRI) growth rate of the past 10 years. If this growth rate is higher than 20% a year, it is set to 20%. If this growth rate is less than 5%, it is set to be 5%. |

Terminal growth in years | Enter the number of years to calculate the terminal value. The value after this is considered zero. The default is 5 years. |

Discount rate in % | Enter the discount rate in percent. A reasonable discount rate assumption should be at least the long term average return of the stock market, which is about 11%, because investors can always invest passively in an index fund and get an average return. Some investors use their expected rate of return, which is also reasonable. A typical discount rate can be anywhere between 10% and 20%. |

Fair value | The fair (intrinsic) value of the share determined as the sum of future earnings at the growth stage and the terminal value. |

Growth value | The cumulative earnings during the growth stage discounted to current using the discount rate. |

Share price | The current price of the security. |

Terminal value | The cumulative earnings during the terminal stage discounted to current using the discount rate. |

| If you have changed one or more input parameters, then the "Discard changes" button will appear at the top of the widget, allowing you to reset the settings to their default values. |

Point to the info icons of the parameters to view information about the fields in pop-up windows.

In the Widget Gallery, you can find the "Fair Value Calculator (Share)" widget in the "Calculators" section of the widgets for shares.